Transition from a Charter church to a Covenant church

Interested in transitioning your existing Foursquare Charter church to a Covenant Foursquare church? Let’s get started!

The Birth of The Covenant Church

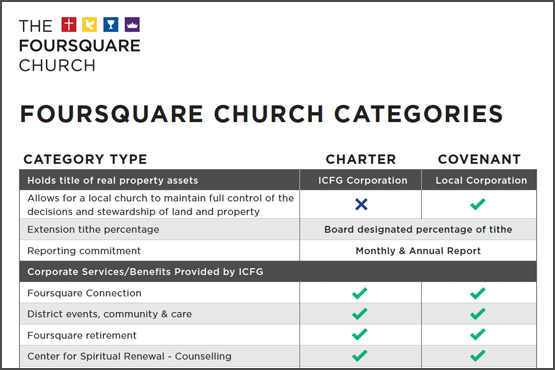

The idea of a Covenant church has been in the heart of Foursquare leadership for many years as one option for churches to be part of the Foursquare family through something called the Foursquare Association. The concept of Covenant church was totally recast in 2016 to fulfill a longtime goal of creating new options for local Foursquare churches to own and manage real property, which is a contrast to our historical model for property ownership where title to real property has been jointly owned by all Foursquare churches via our corporate structure.

The transition to a Covenant church is a complex process because state, federal and IRS regulations govern the closure of one church and the beginning of another. The Foursquare Church has provided documents and charts to simplify, outline and coach a church through these processes, and consultation is available as needed.

The Covenant Agreement Adopted

In June 2016, the Foursquare convention body adopted a bylaw revision to provide for a Covenant church to be a local Foursquare church, but with its own corporate existence. The unique feature is the existence of a written covenant agreement, voluntarily entered into by the International Church of the Foursquare Gospel (ICFG) and the local Covenant church. In the covenant agreement, the local Covenant church pledges itself to adhere to the bylaws of ICFG and to operate fully as a local Foursquare church. In turn, ICFG pledges itself to provide the same covering and care to a local Covenant church that would be given to a Foursquare Charter church.

This new provision is an important step intended to remove barriers for existing churches that want to be part of the Foursquare family and yet maintain direct responsibility for decisions to buy, sell, improve, encumber or lease property. The setup, differences, process and other details are outlined herein.

Interested in transitioning from a Charter to a Covenant Church? Here’s how.

The steps below outline a clear pathway from Charter to Covenant status. It is worth noting that there are significant demands on the administrative and leadership functions of a local congregation. Please be sure to fully review the FAQ document and guide for details on costs—in dollars, personnel and time—that the legal process requires.

Orientation

Church reviews

orientation video

and materials

explaining what

it means to be a

Foursquare

Covenant church.

This orientation video will outline the Covenant church process by illustrating the most important aspects of the covenant relationship and the steps involved in the application process.

We also recommend you read the Frequently Asked Questions document, which addresses the most common questions about the transition process.

Consultation

District

consultation &

pre-approval

from ICFG Board.

In order to move forward with an application to transition a Charter church to a Covenant church, the senior pastor and church council should schedule a call or visit with the district supervisor and/or their designated representative to pray and discern together whether this is the right arrangement for the church. If there is a decision to proceed, the district will present the request to the ICFG Board of Directors for their pre-approval prior to a church investment in the formation of a new nonprofit corporation. Pre-approval includes determining whether a reversionary clause would apply to the property transfer. (Please contact your district office for more details on if a reversionary clause applies.)

Vote

Local congregation

votes to transition

to a Covenant

church.

The covenant agreement outlines the nature of the relationship between the Covenant church corporation and ICFG. This agreement entitles the Covenant church to the same level of support and benefits that are available to Charter churches. In turn, the Covenant church agrees to adopt the Foursquare bylaws in place of its own, and agrees to operate in accordance with all Foursquare policies and procedures. Due to the significance of the covenant agreement, the agreement must be ratified by a 3/4 supermajority of the congregants and attestation of such through the signatures of the senior pastor and members of the church council.

Incorporation

Church retains

StartChurch to

establish

a nonprofit

corporation

within their state.

After the pastor and leadership team of the church discuss becoming a Covenant church with the district representative and agree to move ahead with the application process, the church should form a nonprofit corporation with its state.

The incorporation process for nonprofit organizations varies from state to state. For your convenience and ease, special pricing has been arranged with www.startchurch.com (1-844-549-4506), a company specializing in church incorporation. Startchurch.com understands the Foursquare structure and covenant agreement and will prepare articles of incorporation and bylaws that have been vetted by the Foursquare legal department. Startchurch will also apply for your federal employer identification number (FEIN) with the Internal Revenue Service (IRS), provide step-by-step instructions for registering the corporation with the state and draft an outline to help you prepare initial board meeting minutes. Using a preferred vendor is not required, but it will expedite the review of the corporation paperwork required for presentation to the ICFG board.

Startchurch.com has associates who speak English and Spanish. To obtain the Foursquare pricing of $699 (plus state fees) and receive the incorporation documents for a Foursquare Covenant church, please mention that you are part of the Foursquare group.

Any church desiring the use the services of a different attorney or law firm to establish a corporation may download this introductory letter from Foursquare’s general legal counsel. This letter will provide context and helpful notes to assist the church’s attorney in the formation of a nonprofit corporation to serve as a Foursquare Covenant church.

Note: In many cases, a Charter church may continue to use the same name when establishing a Covenant church. However, state regulations on entity names differ by jurisdiction; therefore, additional steps may be required to continue using the same name. The district and central offices will provide guidance in this process.

Documentation

Church completes form AR-8c and gathers

copies of important documents.

The district office will provide Foursquare form AR-8c (Application for a Charter Church to Become a Covenant Church.) This form includes a request for copies of the documents listed below along with church council signatures attesting their agreement to transfer assets (real and personal) from the Charter church (ICFG subunit) to the Covenant church corporation. This transfer of assets does not include land or buildings which fall into the category of (legacy assets) which must remain on the balance sheet of ICFG. For more information about legacy assets, please consult the frequently asked questions document.

The district and central office will review the documents listed below (and itemized in section 2 of form AR-8c) as part of the application process:

Articles of incorporation

Articles of incorporation is a formal legal document filed with the state to document the creation of a corporation.

Note: If the leadership team of a church already composes the board of a separate nonprofit corporation used for a ministry purpose, and if the church wishes to use this corporation for the Covenant church, please contact your district office to discuss this option.

Bylaws

Nonprofit corporations have bylaws that govern the operations of the church. By signing the Covenant agreement, the Covenant church board voluntarily agrees to apply Foursquare bylaws in place of its own bylaws and to operate the church in accordance with all Foursquare policies and procedures. As a result, this nonprofit corporation will be recognized as a Foursquare church (as defined in the Foursquare bylaws) with respect to all ecclesiastical, polity and relational issues. For transactions concerning real property, Covenant churches are required to follow the process specifically outlined in the Foursquare bylaws, which identifies two unique provisions for Covenant churches. Specifically, ICFG board approval for property transactions is not required, and the title of property will be placed in the name of the Covenant church corporation and not that of ICFG.

Note: If the Covenant church plans to use an existing nonprofit corporation, the signed Covenant agreement will specify that Foursquare bylaws will, thereafter, supersede the local church corporation’s existing bylaws.

Insurance policies

Every Foursquare (Charter or Covenant) church is required to maintain adequate insurance for church activities. This obligation is the joint responsibility of the pastor and members of the church board/council.

If you currently hold Foursquare insurance you will be able to retain Foursquare insurance. However, if you hold insurance with an outside provider, you will not be able to obtain Foursquare insurance and may stay with your current insurance provider.

If you hold insurance outside of Foursquare you will be asked to submit copies of current insurance policies (including property, liability, worker’s compensation, sexual misconduct and officer’s/directors insurance) with the application so the Foursquare Insurance Department can confirm that the new policies meet required minimum coverage limits. These minimum coverage limits can be found in the Insurance Service Policy Notebook on the Foursquare Insurance Department webpage under the section titled, (Information for Securing Insurance with a Carrier other than through Foursquare Insurance Services.) If you need assistance or have questions, please contact the insurance department directly at 213.989.4400.

Federal EIN

As part of the incorporation process, a new Covenant church will receive a federal tax identification number, also called an employer identification number (EIN). A copy of each of the EIN letter should be provided to the district office with the application packet.

List of Assets and Liabilities

A list of the depreciable assets held on the books of ICFG is available through the church property report in The Foursquare Hub. The church should also make a list of any outstanding contractual obligations (leases, loans, copier leases, vendor credit, credit cards, or other outstanding payables). A comprehensive list will help the district and central offices ensure these assets and liabilities are assigned to the new corporation before the Charter church tax identification number is discontinued. The district office will provide a document for the Covenant church board to sign in order to consummate this transfer.

Note: Transferring assets, liabilities, employees, etc. from one entity to another is a comprehensive process. Please see Step 10 for a detailed list of these responsibilities.

Certificate of good standing from state of incorporation

A certificate of good standing is a document that verifies the corporation is current with regard to statutory requirements and is authorized to do business in the state.

List of officers and directors

State laws require a corporation to have a board of directors and corporate officers. The church council will serve as the church board for purposes of maintaining the corporation, managing local church property and satisfying state requirements. As stated in the covenant agreement, the church board will be considered the church council for all other matters and will operate within the powers and responsibilities stated in the Foursquare bylaws. A complete application packet must include a list of the names and positions of the current corporate officers and board of directors for the Covenant church corporation.

Lease agreement for legacy assets

Legacy assets are assets, primarily real estate, with title held in the name of the ICFG corporation. If the Charter church has legacy property, the legacy property and if applicable, its mortgage, will continue to be held by ICFG. The district office will provide a leaseback agreement stating that ICFG is leasing back the property to the Covenant church. After the corporation is formed, this agreement should be signed by the church board. The leaseback agreement will be signed on behalf of the ICFG board simultaneous to signing the Covenant agreement. The signed copy will be returned to the Covenant church after board approval.

The Covenant church will continue to use, control, and be responsible for the property as it did when operating as a Charter church. This includes making mortgage payments (if any), maintaining the property and maintaining the appropriate property insurance.

Because ICFG still owns the legacy property, any property transactions involving the legacy property must follow the property transaction bylaws for Charter churches. The ultimate goal of the Reimagine process is to transfer title of legacy assets to Covenant churches; this plan is being formulated.

IRS 501(c)(3) determination letter if applicable

The corporate secretary’s office will notify the IRS that the Covenant church is to be included under ICFG’s 501(c)(3) group tax exemption; therefore, the Covenant church is not required to apply for a separate exemption. The corporate secretary’s office will notify the church in writing of this submission and will provide a copy of the verification letter from the IRS indicating the corporation has been included under ICFG’s group exemption. This letter should be kept on file as part of the Covenant church corporation’s permanent records.

A Covenant church is at liberty to pursue a separate 501(c)(3) tax exemption, and will be included under ICFG’s group exemption until the church obtains a separate determination. (IRS Form 1023, application to obtain 501(c)(3) tax-exempt status, is best completed by a trained professional to prevent unnecessary delays. A Covenant church can expect to receive a decision by the IRS approximately 2 to twelve months from the date of submission and payment of the application fee. For more information about obtaining IRS 501(c)(3) tax exempt status, please visit the IRS frequently asked questions web page. Legal assistance to obtain 501(c)(3) status is a service available from www.startchurch.com.

Note: If the church holds a separate corporation and IRS 501(c)(3) tax-exempt status, the corporation will keep its tax exempt status, and ICFG will not include the Covenant church in its group tax exemption. A copy of the IRS determination letter should be supplied to the district office as soon as it becomes available.

Submit to District

Church submits

AR-8c application form, supporting

documents & signed Covenant agreement

documenting ¾ supermajority

congregational vote and church board

signatures.

A complete application packet will consist of form AR 8-c, the signed Covenant church agreement documenting the 3/4 supermajority vote, along with the supporting documents listed in step 5 of this guide. Once completed, this packet should be delivered to the district office, including original signed copies of the covenant agreement and application form. The district office will review the application for completion and prepare the file for ICFG central office review and board approval. If there are any additional follow-up questions or missing information, the district office will contact the applicant directly.

Schools, Preschools, and Daycares

Foursquare Charter church that operates a schools, preschool and/or daycare as a subordinate unit of ICFG, the school, preschool and/or daycare operations will transfer the operation of those programs to the Covenant church corporation, per the covenant agreement.

All administrative responsibilities outlined in this document also apply to the operation of schools, preschools and daycares. Since these activities are usually registered with and regulated by the state, there may be some additional steps to ensure compliance in the transfer of responsibility to the Covenant church corporation. Please contact your district office for more information.

Schools, preschools and daycares that operate under a corporation separate from the Covenant church or Charter church will continue to operate as separate entities. These are not subject to the ICFG requirements or oversight and will not be included in covenant agreement.

Review Application

Central office

departments

review application

and copies

of important

documents.

Upon receiving a completed application packet, the Foursquare One Team will review the application and documentation provided and correspond through the district office if additional information is needed. When the review is complete, the application will be submitted for inclusion on the ICFG board agenda.

Board Approves

ICFG Board of

Directors

issues resolution

to approve

application and

transition church

to Covenant status.

The ICFG board will review the summary provided by the district and One Team departments and issue a resolution to approve the transition from Charter church to Covenant church status.

Startchurch.com has associates who speak English and Spanish. To obtain the Foursquare pricing of $699 (plus state fees) and receive the incorporation documents for a Foursquare Covenant church, please mention that you are part of the Foursquare group.

Any church desiring the use the services of a different attorney or law firm to establish a corporation may download this introductory letter from Foursquare’s general legal counsel. This letter will provide context and helpful notes to assist the church’s attorney in the formation of a nonprofit corporation to serve as a Foursquare Covenant church.

Note: In many cases, a Charter church may continue to use the same name when establishing a Covenant church. However, state regulations on entity names differ by jurisdiction; therefore, additional steps may be required to continue using the same name. The district and central offices will provide guidance in this process.

Sign Agreement

ICFG signs Covenant agreement with local church corporation.

Upon approval, the covenant agreement will be sent to the corporate secretary’s office to obtain signatures on behalf of the ICFG corporation to execute the transfer of the church’s operations to the new corporation. The district office will provide a written copy of the board resolution and a copy of the signed covenant agreement for the permanent records of the church.

Open New Accounts

Church establishes new accounts with banks, vendors, payroll services,

tax authorities, etc. and re-hires staff under new corporation.

The Charter church EIN will be officially closed approximately 60 days from the date of the ICFG board resolution. Once the Charter church EIN is discontinued, it will become invalid and no longer enable the church to transact business as a subunit of ICFG. In preparation for this transition, the Covenant church must establish new accounts with banks, vendors, payroll services, tax authorities, and any other services used to transact church business. The list below outlines the most common accounts that will need to be opened by the Covenant church:

Assets and Contractual Liabilities: Checking, Savings, Investments, Money Market Accounts

Bank accounts should be opened under the name and EIN of the Covenant church in preparation for the transfer of church assets. The Covenant church should order new checks, endorsement stamps and deposit slips.

Restricted Funds

Some restricted funds may require donor approval prior to transferring the funds. Please contact your district office to see if this additional step is required.

IFLF Savings Accounts

ICFG is not registered with the Securities Exchange Commission (SEC) and, therefore, can not provide savings accounts to external entities. Funds held in IFLF savings accounts may be placed on deposit with Foursquare Financial Solutions Loan Fund (FFSLF) as a deposit certificate, or they may be transferred to another bank or credit union. The Covenant church should consider its liquidity needs and establish new savings accounts with church council approval in accordance with Foursquare bylaws. Foursquare administrative specialists are available for consultation about savings options.

Credit, Debit and Merchant Service Gateways (for online donations)

If the Covenant church wishes to establish accounts to facilitate the electronic receipt or disbursements of funds, new accounts must be established under the Covenant church EIN.

Transition of Operational Systems

Covenant churches will need to establish new accounting records for the Covenant church corporation. It is not permissible to simply change the name and continue using the same data files for accounting, membership, and contribution records that were used for the Charter church. It is advisable for churches to export the donor and vendor contact records (or databases) from the existing software into a blank data file prior to transferring church operations to the new corporation.

Transitioning employees and payroll State Tax Identification number

A Covenant church that operates in a state that require the filing of state returns must establish an account with the state tax authority under the Covenant church’s federal tax ID number (or EIN).

W9s

A Covenant church that hires independent contractors to perform work should request a new IRS form W9 from each contractor before the making any payments for services. IRS from W9 is an important record of the contractors’ address and social security number that is used to substantiate the church’s issuance of IRS form 1099’s each calendar year.

Employment Forms

Since all employees of the Covenant church are technically new hires under the Covenant church corporation, these employees must complete new W-4s and I-9s for the new employers’ records. Additionally, the Covenant church council/board will need to designate ministers’ housing allowances in the minutes of the corporation’s first board meeting. In order to ensure that there is no lapse in housing allowance benefits, this approval should happen within 30 days of the effective date of the transition from Charter church to Covenant church.

Close Old Accounts

Church satisfies all

outstanding financial

obligations (employee benefits, contracts, loans, etc.) or assigns liabilities to new corporation.

The Charter church EIN will be discontinued by ICFG within 60 days of the ICFG board’s approval of the Covenant church application. All outstanding financial obligations should be satisfied within this period. Examples include the following:

Contractual Liabilities

The church must satisfy or assign all contractual liabilities other than mortgage payments legacy property. These obligations will be addressed separately through a lease agreement between ICFG and the Covenant church corporation. The Covenant church will need to re-establish or assign vendor relationships, health insurance plans and subscriptions in the name and under the EIN of the Covenant church corporation.

Real Estate and Equipment Leases

All facility and equipment leases must be paid in full or reassigned to the Covenant church corporation.

Credit, Debit and Electronic Giving Accounts

The Charter church must close all electronic donation or disbursement accounts held in the name of the Charter church.

Employees and Payroll Obligations

Although the church employees will continue to be employed by the church, from a technical standpoint, their employment arrangement will terminate with the Charter church (subunit of ICFG) and will begin anew with the Covenant church corporation. Each state has specific regulations governing the transition of employees from one entity to another. In most states, employment laws require that all outstanding employment obligations (such as unpaid vacation and sick time) are satisfied, along with any other provisions of termination policy in the church’s employee handbook. In cases where no employee handbook exists, terminations must be processed in accordance with the established practice of the church. Some states may allow the unpaid benefits to be assigned to the new employer without requiring the church to “cash out” employee benefits. For more information on state requirements, please contact the district office.

Transfer Assets

ICFG transfers operations and assigns leases to local church corporation – entity changes are updated in The Foursquare Hub.

Once new accounts have been established as described in step 11 of this guide, the day-to-day operations of the church will commence under the Covenant church corporation. The church leadership must consider the following areas:

Assets and Contractual Liabilities

The church will transfer all cash or liquid assets of the Charter church to the Covenant church. This transfer of assets will require closing all bank accounts in the name and EIN of the Charter church and transferring those funds to a bank account in the name and EIN of the Covenant church.

Restricted Funds

All restricted funds should be transferred to a similar restricted fund within the Covenant church.

IFLF Savings Accounts

IFLF savings can be transferred to Foursquare Financial Solutions Loan Fund (FFSLF) as a certificate of deposit, or can be placed on deposit with another another financial institution.

Liabilities

All liabilities, contracts, health insurance plans and subscriptions should begin to operate under the Covenant church EIN.

Real Estate /Equipment/Other Leases

All real estate, equipment or other leases should commence in the name of the Covenant church.

Credit, Debit and Electronic Giving Accounts

The Covenant church should begin using accounts in name of the Covenant church for all future electronic transactions.

Utilities

All utilities should be transferred into the name of the Covenant church corporation.

Contribution Statements

Donor contributions must be substantiated by the organization that received the donations. If donors made contributions during the year to both the Charter and Covenant church, separate contribution statements should be issued to reflect the contributions made to each distinct entity.

Accounting Software and Church Management Systems

The Covenant church must begin using the new data files established for the Covenant church corporation for accounting, membership records and contribution statements.

The Foursquare Hub

The Foursquare Hub is a database that tracks activity concerning churches and ministers in the Foursquare denomination. The church’s activity records in The Foursquare Hub will be updated to document the change in status from Charter church to Covenant church, along with the effective date of this change. This update will not affect the ID numbers of the church or appointed ministers.

Payroll and Housing Allowances

If the transition happens on any date other than January 1, both the Charter church and the Covenant church will be responsible to file payroll returns under the respective names and federal/state employer number(s) of each entity. State filing requirements may vary. In most cases, employees will receive a W-2 and/or housing allowance letter from each entity in for the applicable pay period.

1099s

If the transition happens on any date other than January 1, both the Charter church and the Covenant church will be responsible to issue IRS Form 1099s, per IRS guidelines, under the respective names and federal/state employer number(s) of each entity for the calendar year.

Covenant Church

The local church board assumes responsibility for

property decisions, but operates as a Foursquare church per the Covenant agreement.

As stated in the covenant agreement, the church board will be responsible for the administration of the local church corporation and will serve as the church council for all responsibilities referenced in the Foursquare bylaws and policies. The local church board will be responsible for maintaining its corporate status and complying with all state and federal laws. Most states require annual filings with the state of incorporation to remain in good standing.

Ongoing Support

Foursquare districts and One Team provide ongoing support, resources, consultation and care.

Many resources are available to local church leaders through the Foursquare Administrative Toolkit. This Website provides a comprehensive library of videos, templates, diagrams and other helpful resources that may assist the church with administrative processes. The Website is organized by topic and each section offers practical tools to support the legal and financial responsibilities of pastoral leaders. Topics include the following: clergy taxation, church compensation practices and the roles and responsibilities of a church council.

District offices will continue to provide the same level of care and consultation for a Covenant church after the transition is complete and will continue to be the first point of contact for questions concerning the church or its leaders.

Is transitioning your church from Charter to Covenant the path for you? Let’s get going!

Get all the details!

Have Questions?

Ready to Apply?

Are you an existing church interested in becoming a Foursquare Covenant church?

When your existing church joins the Foursquare community as a covenant church, you will receive the spiritual care, leadership and resources that a worldwide movement can provide.

Are you a new church plant?

This page outlines the process for existing Foursquare churches. If you are a new church plant trying to determine if becoming a Covenant church is the right fit for you, visit our page for new church plants.

Not a Foursquare Church but looking to affiliate?

Foursquare Community churches are completely autonomous and independent legal entities. A Foursquare Community Church affiliates with Foursquare but is not a Foursquare legal entity. There are numerous benefits to becoming a member of the Foursquare Association as a Community Church.